On July 16, 2021, China officially kicked off the National Carbon Emissions Trading System (ETS).

The National Carbon Emissions Trading System starts operation

Initially, the China ETS was intended to be started by 2017, encompassing eight major industries, such as electricity and iron & steel. As the result, the actual start-up only included the power generation sector, with a four-year delay. The delay was attributed to the reasons like low-quality emission data submitted by relevant companies and slow development of emission allowance allocation methodology.

The initial targets are the 2,162 businesses that emitted greenhouse gas (CO2) of more than 26,000 t-CO2 equivalents (CO2e) during any one year between 2013 and 2019. These include power generation and heat supply companies, and the companies from other industries with self-owned power generation facilities (i.e., pharmaceuticals, petrochemistry, chemical fiber, metal, food, paper making, etc.). The total amount of emissions by the companies under the national ETS is around 4.5 billion tons, about 40% of China’s total CO2 emission.

Transaction overview

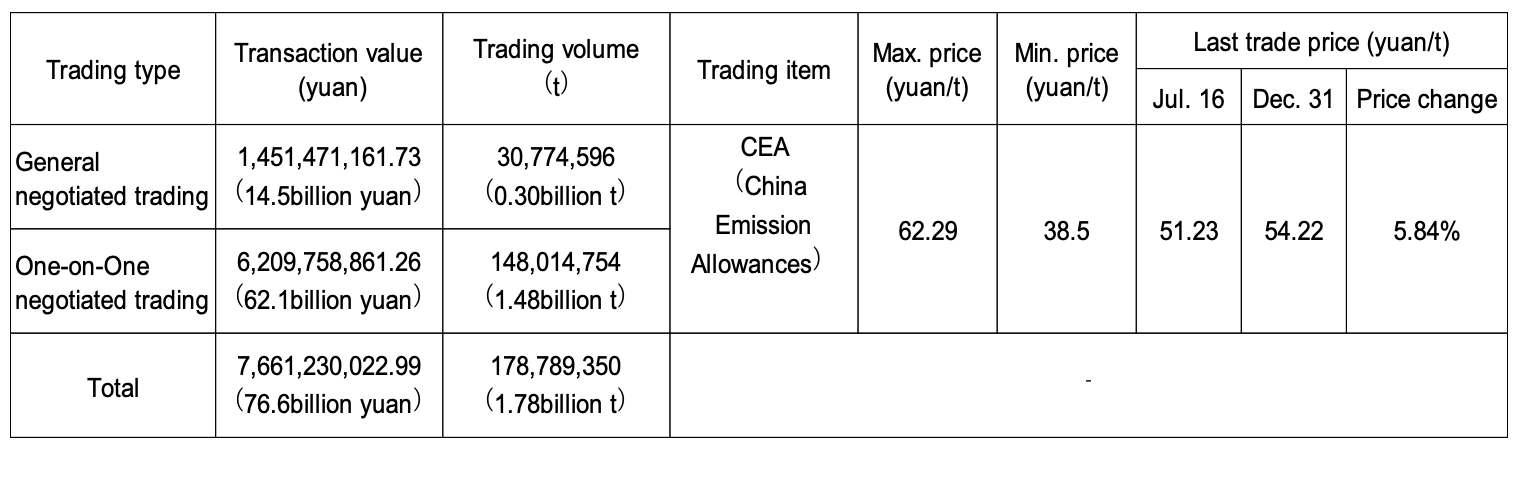

During 5.5 months from July 16, 2021, when trading started, to December 31, 2021, the total trading volume of allowances reached 178 million tons. The total trading value reached 7.66 billion yuan (about 122.6 billion yen, monthly averaged 25.5 billion yen). On the trading volume basis, the average price of allowances is around 43 yuan/t (about 690 yen/t), much lower than the EU-ETS price (approximately 10,000 yen/t). However, considering that the carbon price of Korea ETS, which was launched on January 1, 2015, has gradually increased from about 1,000 yen/t (annual average) in the first year to the current 3,500 yen/t, the carbon price of China’s national ETS may also rise in the future.

Trading methods can be overall divided into general negotiated trading (equivalent to auction trading) and One-on-One negotiated trading (bulk negotiated trading). In the former method, sellers and buyers present desired trading volumes and prices in advance to allow the trading system to select matching pairs among the top five price competitors. This applies to a trading volume smaller than 100,000 t- CO2e. On the other hand, the latter is applied to 100,000 t- CO2e or larger trading in volume, where the seller and the buyer negotiate one-to-one on pricing, make a contract, and execute the transaction at an agreed amount. The entire process can be completed using the online system provided by the exchange. In fact, more than 80% of the total trading volume was accomplished by bulk negotiated trading.

Table. First year results of China’s national ETS (July 16 to the end of December, 2021) / Source: The table was created by the author based on Shanghai Environment and Energy Exchange data.

Final results

Any businesses subject to the China ETS are obliged to settle the emissions from their business activities (power generation and heat production) by the allowances to the government by the following year (liability of allowance settlement). However, only for the first year of the introduction of ETS, companies are required to balance emission allowances for the years 2019 and 2020, and the deadline is December 31, 2021. 99.5% of the companies have fulfilled their duty to settle emission allowances by the deadline.

The figures show that the China ETS is off to a good start.

—

* Part of the text is cited from the author’s serial journal article, “Dramatic Changes in China: Climate Change Policy after the Paris Agreement”, published in the September and November 2021 issues and the January 2022 issue of Chikyu Ondanka (Prevention of Global Warming).

—

Text: Jin Zhen (Institute for Global Environmental Strategies)